-

Step 1. The supplementary cardholder accesses the application URL generated by the primary cardholder and enters the basic information of the supplementary cardholder.

- Reminder:

- The date of birth should be entered as a 3-digit ROC year followed by 4 digits for month and day, for example: 1131013.

- Please read the application terms carefully and check the box. After confirming that all information is correct, click “送出(Submit)”.

-

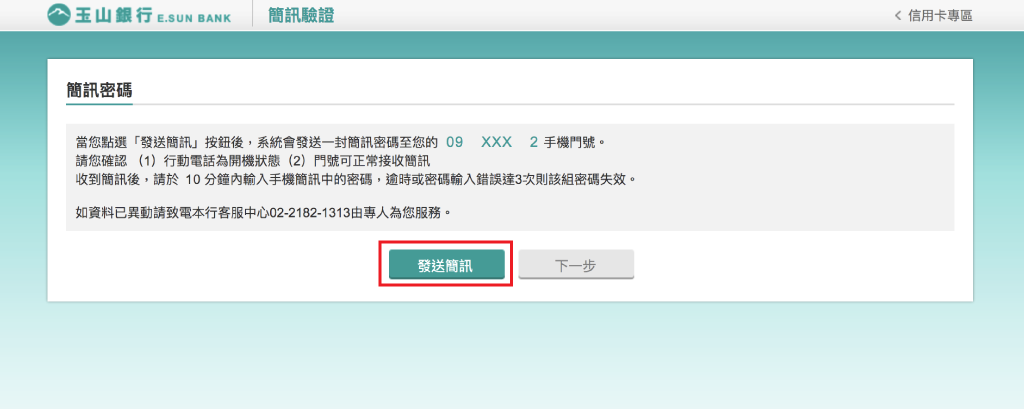

Step 2. Perform supplementary cardholder identity verification.

You can verify your identity using SMS OTP (for E.SUN Bank cardholders/depositors only), a credit card issued by another bank, a deposit account at another bank, or a Citizen Digital Certificate.

(1) SMS OTP Verification (for E.SUN Bank cardholders/depositors only)

- Reminder:

- If you wish to update the mobile number registered with E.SUN Bank, please contact our Customer Service Center at (02) 2182-1313.

(2) Verification using a Credit Card issued by another bank

- Reminder:

- First, please enter the credit card number, card expiration date, and mobile phone number. Then, read the application terms carefully and check the box: “I have read and agree to the above terms.” After confirming all information is correct, click “送出 (Submit) ”.

- You can click “適用銀行 (Eligible Banks) ” at the top right corner to check the list of designated banks.

(3) Verification using a Deposit Account at another bank

- Reminder:

- Digital deposit accounts are not applicable.

- The mobile number must be the same as the one registered for SMS password service with the bank.

- To enable identity verification, the designated bank must participate in the Financial Information Service Co., Ltd. (FISC) “Interbank Financial Account Information Verification (PCODE 2566) ” platform.

- Accounts from other banks are for verification purposes only and cannot be used as proof of financial resources.

(4) Verification using a Citizen Digital Certificate

-

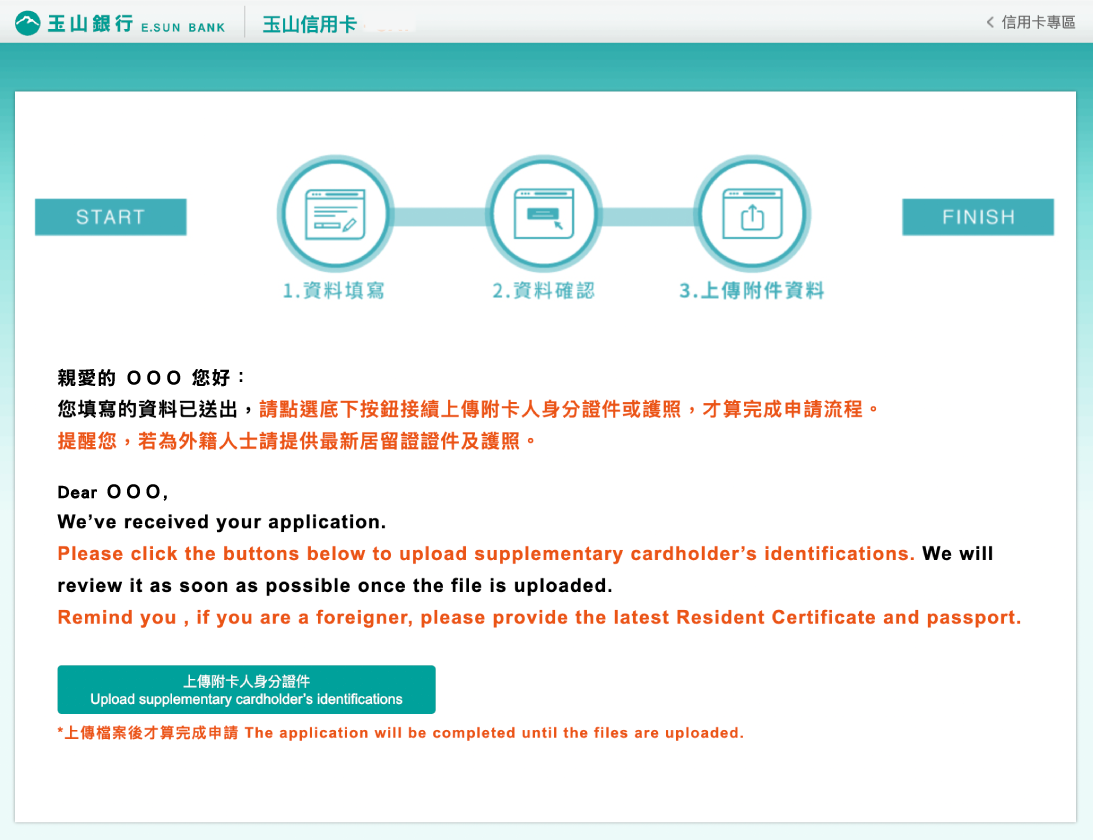

Step 3. Fill in the supplementary cardholder's application information.

-

Step 4. Upload the front and back of your ID card to complete the application!